Investors worldwide are in panic mode after U.S. President Donald Trump announced sweeping new tariffs, intensifying fears of a full-scale trade war. In a dramatic move, Trump imposed a minimum 10% tariff on all imports to the United States, with even higher duties targeting major trade partners like China, Japan, and the European Union.

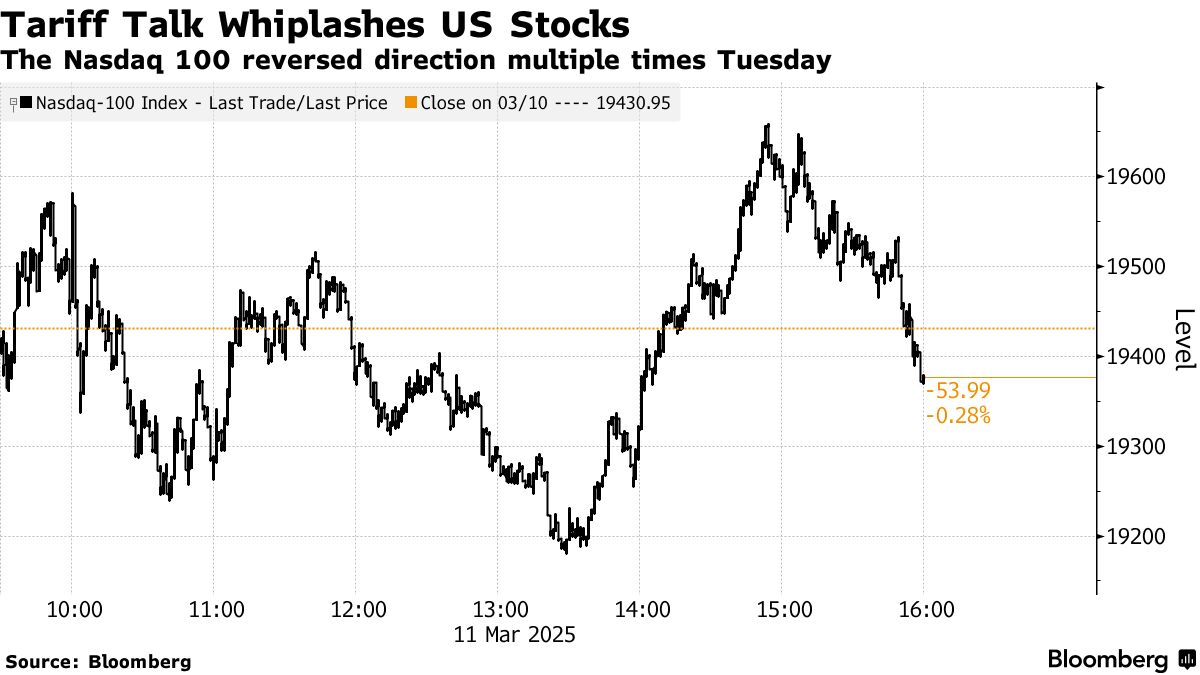

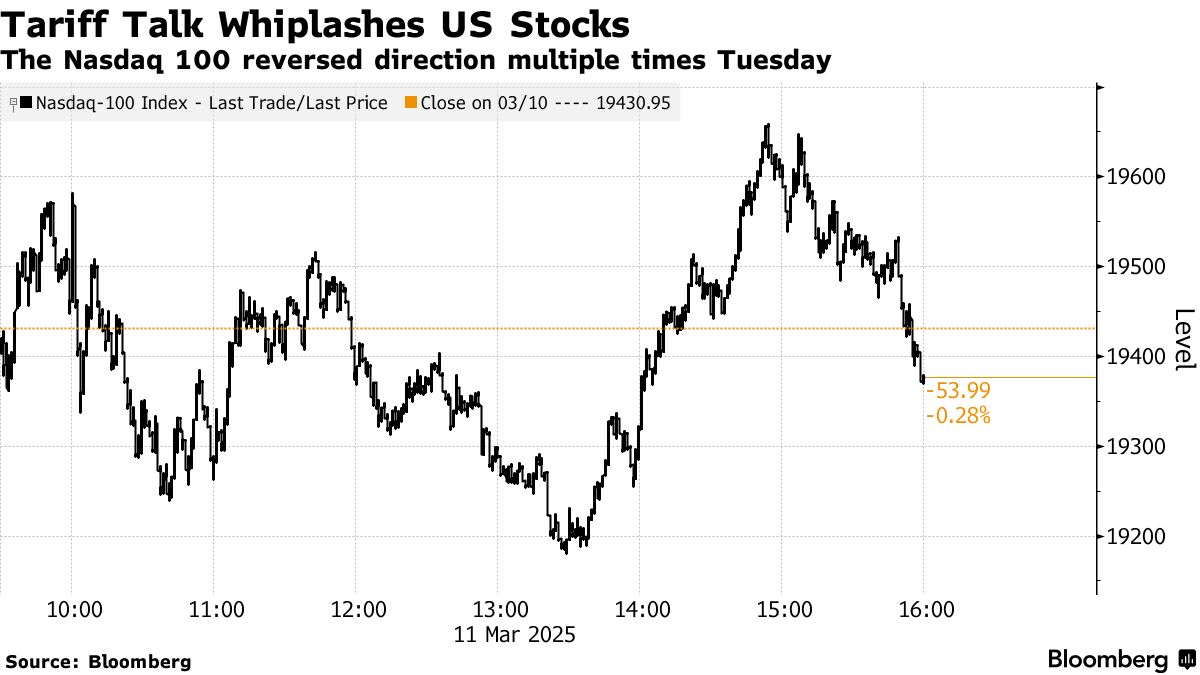

The reaction was swift and severe. U.S. stock futures plunged, with the S&P 500 down over 3%. Big tech names weren’t spared—Apple dropped nearly 7%, while Amazon, Dell, and Tesla each fell more than 4%. Apparel giants like Nike and Deckers took an even bigger hit, tumbling nearly 11% due to heavy tariffs on key manufacturing hubs like Vietnam.

The ripple effect spread across global markets. Europe’s Adidas and Puma sank nearly 10%, dragging the Stoxx 600 index down 1.5%. In Asia, Japan’s Nikkei index fell almost 3%.

As fears of retaliation from China and the EU grow, investors are fleeing to safe havens. Yields on U.S. 10-year Treasuries dropped to their lowest in over five months. Meanwhile, the Japanese yen and Swiss franc rallied, and gold prices briefly hit a new all-time high.

Justin Onuekwusi, CIO at St James’s Place, warns: “Markets haven’t fully priced in the worst-case scenario. If retaliation escalates, we could see a much deeper sell-off.”

(By Ziqi Qin)